Unraveling the Mystery of Candlestick Triangular Patterns: A Guide to Spotting and Utilizing Triangles in Trading

Introduction:

Candlestick patterns are invaluable tools for traders, revealing market sentiment and potential price movements. Among these patterns, the triangular formation holds a special significance. In this blog, we will explore the intriguing world of candlestick triangular patterns, understanding their types, characteristics, and how to leverage them effectively in trading strategies.

The Anatomy of Candlestick Triangles

We start by explaining the structure and formation of triangular patterns in candlestick charts. From ascending and descending triangles to symmetrical triangles, we'll dissect each type and demonstrate how they differ in appearance and implications.

Bullish Triangular Patterns

Explore bullish triangular patterns, such as ascending triangles, which indicate potential bullish breakouts. Discover how to identify these patterns and interpret their significance for profitable trades.

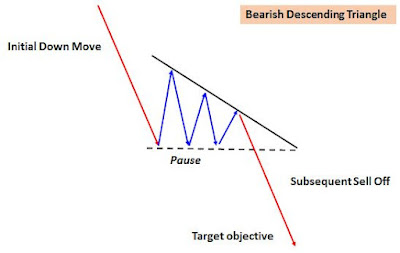

Bearish Triangular Patterns

Uncover bearish triangular patterns, like descending triangles, signaling possible bearish breakouts. We'll discuss strategies to recognize and capitalize on these patterns to minimize losses and maximize gains.

Symmetrical Triangles: The Tug-of-War

Symmetrical triangles are intriguing formations, showcasing balance and uncertainty in the market. We'll explore how to analyze symmetrical triangles and anticipate potential breakout directions.

Volume and Confirmation

Understand the importance of volume in confirming triangular patterns. Learn how volume can validate the strength of a breakout or alert traders to potential false signals.

Trading Strategies with Triangular Patterns

Discover effective trading strategies tailored to triangular patterns. From breakout trades to retests, we'll cover how to position yourself for profitable trades based on these formations.

Combining Triangles with Other Indicators

Learn how to enhance your analysis by combining triangular patterns with other technical indicators like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements.

Risk Management and Stop Loss

Discuss the significance of risk management when trading triangular patterns. We'll delve into setting appropriate stop-loss levels and managing risk to safeguard your capital.

Conclusion:

Candlestick triangular patterns are powerful tools for traders, offering valuable insights into potential price movements. By mastering these formations and combining them with technical indicators and risk management strategies, you can elevate your trading acumen and make more informed decisions in the dynamic financial markets.

As you embark on your journey to spot and utilize triangular patterns, remember to practice and refine your skills. Whether you're a novice or seasoned trader, triangular patterns hold the potential to enhance your trading prowess and unlock profitable opportunities in the ever-evolving world of finance. 📈💡🔺🔻

Comments

Post a Comment